South Africa has such a severe skills crisis that it threatens the hospitality sector

The South African hospitality industry is facing a severe human capital crisis that threatens the sector’s stability and future, according to a new industry report.

The South African Hoteliers Report compiled by Hospitality Asset Management Company, in partnership with Tourism Update, reveals the sobering reality of employment in the hotel industry.

“Recruitment has become nearly impossible, not simply because candidates are scarce, but because those entering the industry often arrive unprepared for its demands,” the report reads.

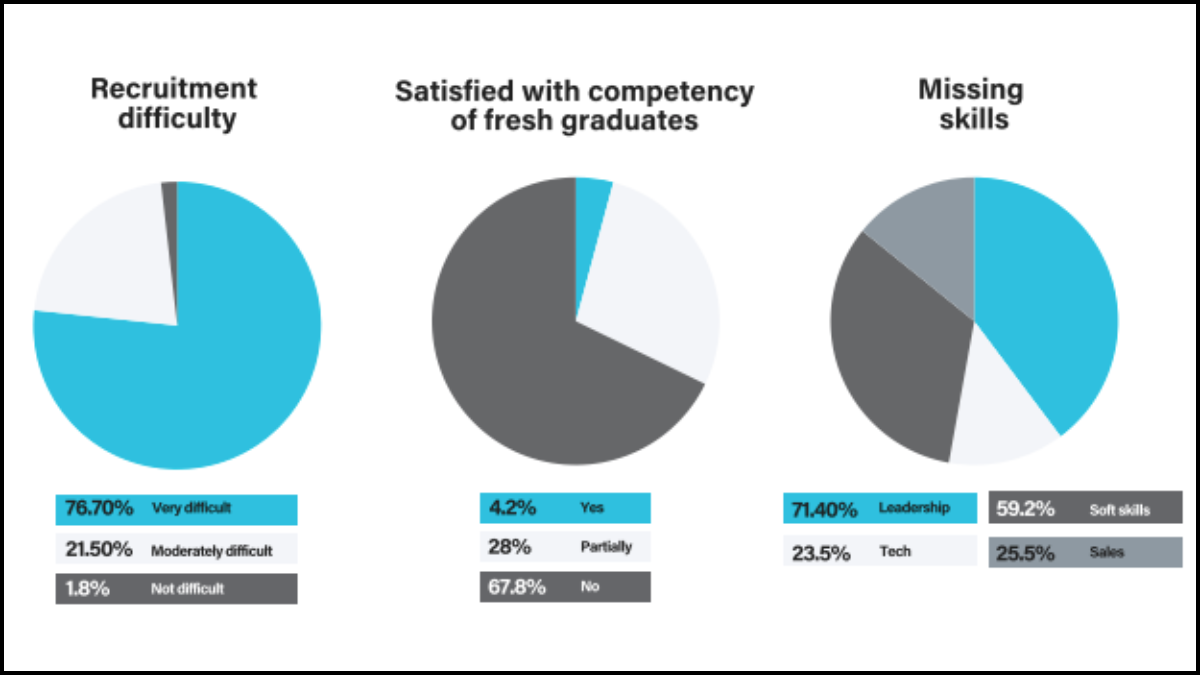

The overwhelming majority of respondents in the report, 76.7%, said that recruitment is “very difficult”.

At the same time, only 4.2% of respondents said that they were satisfied with the competency of fresh graduates.

This echoes statistics from Statistics South Africa (StatsSA), which found that employment in the accommodation industry decreased from 98,444 in 2012 to 83,869 by 2022.

Due to the demands of the job and skills deficits, Retention has collapsed, employees leave exhausted, underpaid and with little room for advancement.

When asked to identify the biggest reasons why employees leave, 46% cited pay as the main driver. The second most-common reason was burnout, with 35%.

Hoteliers mentioned other compounding factors in retaining employees, such as remote, hard-to-access property locations of South African hospitality hotspots, hotels and lodges.

Employers have found that some coming into the industry find that there is a mismatch between the job and their personality, where the expectations and environment of hospitality are not the right fit.

Others leave the industry when they find roles with more stable, predictable hours or due to life changes such as marriage, having children or wanting to work closer to home.

The loss of experienced staff stretches remaining teams, increasing stress and eroding leadership capacity.

A vicious cycle

“This is creating a cycle in which recruitment challenges, turnover, and burnout feed one another, leaving the sector trapped in a widening human capital predicament,” the report finds.

Additionally, the researchers said that qualitative feedback from hotel owners and general managers reinforces these findings.

The industry reports that, while graduates have sufficient theoretical knowledge, they often lack the mindset, behaviour and readiness for real-world work.

The industry now struggles with fundamental structural issues, as compensation fails to retain talent, work intensity exhausts employees, and there is little growth opportunities, leaving ambitious staff with nowhere to go.

The sector faces a compounding issue: losing experienced talent while struggling to replace those who leave the industry with competent newcomers, further exacerbating conditions for remaining employees that lead to burnout.

These conditions have made hoteliers more willing to invest in the development of human capital or the application of technology. 46% of hotel management said they would prioritise workplace development.

However, because of the financial pressure from utility costs, particularly rising electricity costs, these employers find themselves unable to spare the funds.

This is as margins in the hotel sector are under increasing pressure. Labour costs were reported as the biggest cost eroding profitability, by 37.30% of hoteliers.

Utility costs follow closely behind, with 34% of hoteliers citing this as their biggest cost driver. “Electricity prices were particularly noted as severe, an element critical to operations,” the report reads.