Reserve Bank keeps interest rate unchanged

The Reserve Bank’s Monetary Policy Committee (MPC) has kept interest rates unchanged. The repo rate will stay at 6.75% and the prime lending rate at 10.25%.

On Thursday, 29 January, the MPC voted to keep interest rates unchanged following a 25-basis-point cut in November 2025.

The decision was not unanimous. Two members of the Monetary Policy Committee favoured a 25-basis-point cut.

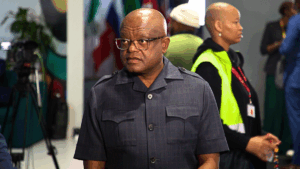

Reserve Bank Governor Lesetja Kganyago explained that the committee assessed the risks to South Africa’s inflation outlook as balanced.

He noted that inflation ticked up to 3.6% in December 2025, but the year-average was 3.2%, which is close to the Reserve Bank’s new 3% target.

The governor said inflation expectations have fallen, with the latest survey showing longer-term expectations at record lows.

“We look forward to expectations declining further, as South Africans experience ongoing lower inflation and learn more about the new target,” he said.

South Africa’s inflation target was officially lowered to 3% in November 2025, a lower and narrower target than the previous 3% to 6% range.

Kganyago said the Reserve Bank’s near-term inflation forecast has fallen, with the rand stronger and a lower oil price assumption.

However, he said the bank is keeping an eye on food inflation, especially meat prices, which are being affected by a serious outbreak of foot-and-mouth disease.

“We are also concerned about electricity prices, given that NERSA’s price correction may rise from R54 billion to R76 billion,” he said.

Market reaction to the Reserve Bank MPC decision

Dr Andrew Golding, chief executive of the Pam Golding Property group, said the MPC adopted a cautious stance by keeping the repo rate unchanged at 6.75%.

He said the decision was not what existing mortgage holders and prospective homebuyers seeking credit were hoping for.

However, most market commentators believe that, with inflation remaining contained, there is scope for up to two 25bps repo rate cuts during 2026.

“The outlook for interest rates is supported by ongoing rand resilience, easing inflation expectations, and softer global oil prices,” he said.

Landsdowne Property Group CEO, Jonathan Kohler, believes the MPC’s latest decision will keep the property market grounded on price and value rather than speculation.

“While the MPC’s decision to hold will disappoint some people, it aligns with the broader expectation of further rate cuts ahead,” he said.

“The Reserve Bank has already eased meaningfully over the past year, and pauses are often part of that process.”

Gavin Lomberg, CEO of ooba Home Loans, said the SARB’s decision underscores a cautious but constructive start to the year.

“A steady interest rate environment, improved consumer affordability and competitive bank lending will drive South Africa’s property industry throughout 2026,” he said.

Garth Rossiter, Chief Risk Officer at Lula, said the decision highlights that uncertainty remains a defining feature of the SME operating environment.

“The SARB traditionally leans toward caution. The primary reason for this would be the newly adopted 3% inflation target,” he said.

For small businesses, this means business as usual, with no immediate relief on debt repayments.

“While the lack of change maintains a stable environment for financial planning, it also keeps borrowing costs relatively high,” he said.

This could potentially delay expansion plans for small and medium-sized businesses in South Africa that rely on credit to scale.