The end of the rand and other currencies as we know them

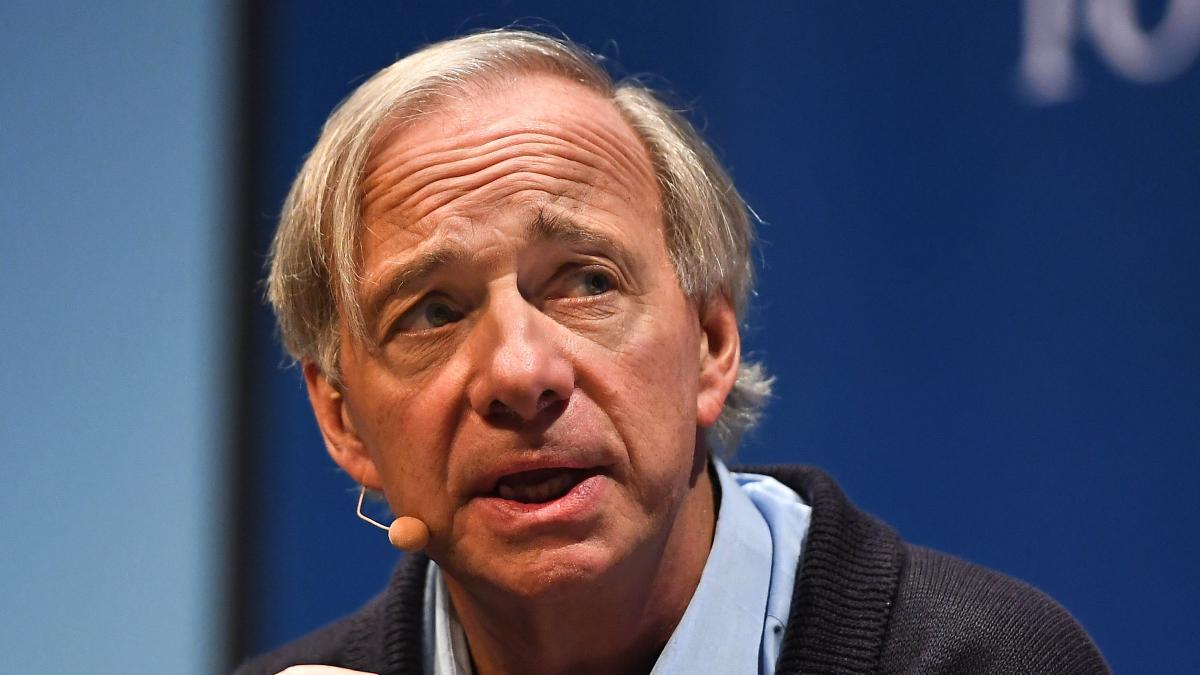

Billionaire investor Ray Dalio said the world is witnessing the beginning of the end of the monetary system as we know it.

Dalio is one of the most respected voices in the investment and finance world, having founded Bridgewater Associates, the largest hedge fund in the world.

He is credited with pioneering several influential investment strategies, including risk parity and the separation of alpha and beta returns.

He is highly regarded for his practical understanding of economics, which includes predicting the 2008 financial crisis.

Dalio has penned many books, including Principles for Dealing with the Changing World Order, which examines why nations succeed and fail.

In a recent interview, Dalio said that the gold price, which has been hitting record highs in recent weeks, is a sign of the breakdown of the monetary order.

He explained that most money today is actually credit, which is nothing more than a promise to pay.

When government debt reaches unsustainable levels, the only escape for the government is to print more money to service that debt.

However, this comes at a cost. Printing money leads to inflation, which, in turn, devalues the currency.

It is widely seen as a hidden tax on citizens, where their money is taken through inflation rather than through a direct tax.

As fiat currencies lose purchasing power, cash becomes trash, and investors flee to assets that cannot be printed.

Dalio pointed to gold’s massive surge over the last two years as a harbinger of eroding trust in the world’s reserve currency, the U.S. dollar.

For the first time in decades, global central banks are buying more gold than U.S. Treasuries. They are diversifying away from the dollar to avoid currency risks.

“It is the beginning of the end of the monetary system as we know it. It is not only the U.S. dollar. It is all the fiat currencies,” he said.

He explained that gold is the only non-fiat currency that cannot be printed, which is why central banks are stockpiling the precious metal.

“Central banks and sovereign wealth funds move to gold. That is the nature of the shift of the monetary system,” he said.

Gold price chart