Walmart’s big plans to beat Checkers and Pick n Pay in South Africa

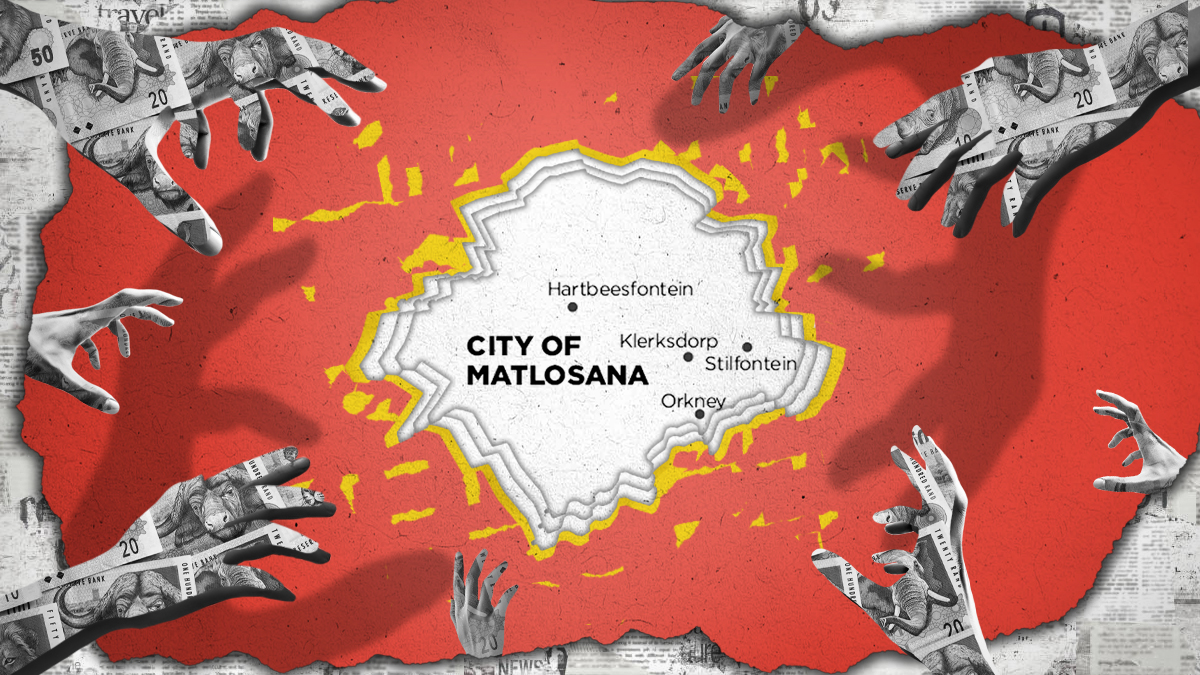

Global giant retailer Walmart has recently opened its first two stores in South Africa, with plans to expand across the country and outprice South Africa’s biggest retail chains.

In an interview with BizNews, Walmart COO for South Africa, Dries D’Hooghe, said that the company has “very ambitious” expansion plans.

Without giving any specific details, D’Hooghe said that Massmart will be looking at converting real estate in its own portfolio across its other brands, including Makro, Game and Builders Warehouse, as well as expanding to new locations.

“We’re not just here to launch two stores,” he said, adding that Walmart will be looking to expand across the African continent in the future. “But we need to win in South Africa first.”

D’Hooghe noted that South Africa is a particularly competitive market, relative to Walmart’s global network.

“I’ve been impressed by the number of brands and how they have each differentiated their brands, even within the same group, to serve the target customer,” he said.

Even so, Walmart plans to compete with South Africa’s biggest brands by outpricing them and through their own 60-minute delivery service, taking on the Shoprite Group’s Checkers Sixty60 service, and low-cost retailers like Pick’ n Pay.

Its main strategy is every-day low prices. “If you buy a basket, you will find that Walmart if the cheapest retailer,” said D’Hoogde.

This was tested by BusinessTech, who compared a standard, 9-item grocery basket at Walmart and South Africa’s biggest retailers: Spar, Pick n Pay, Checkers and Woolworths.

The basket consisted of white bread, sunflower oil, maize meal, white sugar, milk, rice, flour, soap and toilet paper.

The total cost of the grocery basket at Walmart was R362.92. This was found to be comfortably the cheapest in the country.

The same basket costs R412.87 at SPAR, R416.87 at Pick n Pay, R421.91 at Checkers and R440.91 at Woolworths.

In comparison to South Africa’s current market, Walmart operates on a model based on keeping prices low, and not on promotions and specials.

The new competitive kid on the block

“The market is very highly promotional. We believe that over time we will generate trust with the customer and that trust is going to help us win,” said D’Hooghe.

He said Walmart’s experience in the everyday low-cost model, and its global supply chain and buying power, are what allow it to sell products for less than local competitors.

“Part of the Walmart culture is really finding ways to lower costs every day so we can invest in price,” he said. “Secondly, we have access to a global sourcing framework, which also helps us to adjust costs.”

This is not the company’s only strategy when it comes to taking on South African competitors.

The 60-minute delivery promise for homes within a 5 km radius of Walmart stores clearly threatens that of Checkers Sixty60, Pick n Pay Asap, and Woolworths Dash.

D’Hooghe said that in South Africa, this is a must-have to be competitive. “If you’re a food retailer in South Africa, you have to deliver that convenience, and 60 minutes is the market expectation,” he said.

“If you look at other markets, it’s even faster. If you think about India, it’s within 15 minutes, you can get something delivered. So we’re just following the expectation of the customer,” he said.

He added that, while there are competitors in the country that have been delivering for longer, Walmart has a global technology platform it can leverage and learnings it can take from other markets.

In the local market, Checkers Sixty60 will be the competitor to beat. The Shoprite Group’s delivery service is largely credited for revolutionising the quick retail space.

In September 2025, the Shoprite group revealed that it sold R18.9 billion worth of products through the Checkers Sixty60 platform in the last year, up to June 2025.

This is a 48% year-on-year increase. The number equates to almost 40% of the entirety of Woolworths Foods’ business, including its delivery service.

Checkers Sixty60 has more than an 80% market share of on-demand grocery delivery in South Africa, according to Moneyweb.

Agree with Sean Johnson.

Also I question the use of a very basic basket .. it really is skewed and does not reflect the average SA grocery spend .